New Product Development Evaluation – Multiple Leading FMCG Brands (EU Market)

Objective

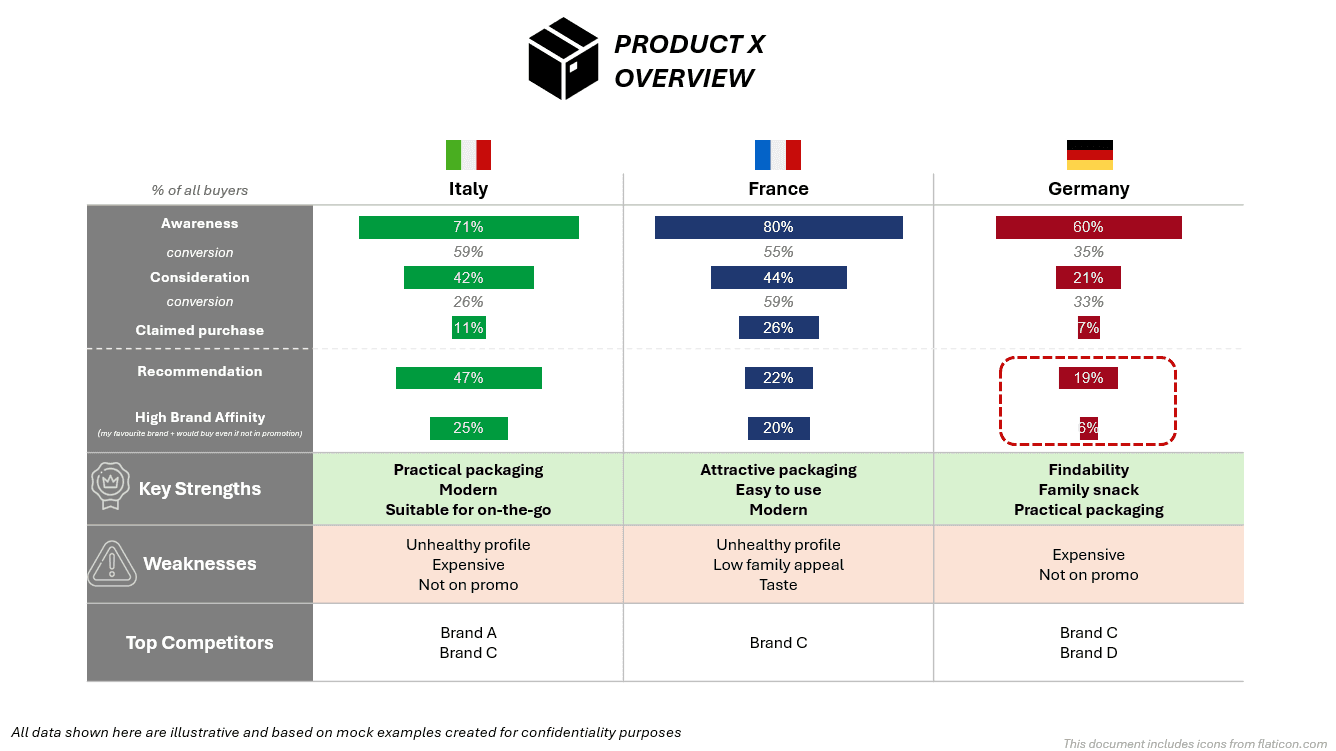

To assess consumer response to newly launched FMCG products across several European markets, providing brands with a clear understanding of post-launch performance, consumer satisfaction, and areas for product improvement.

Methodology

- Quantitative post-launch surveys among recent buyers to measure product appeal, satisfaction, and repurchase intent.

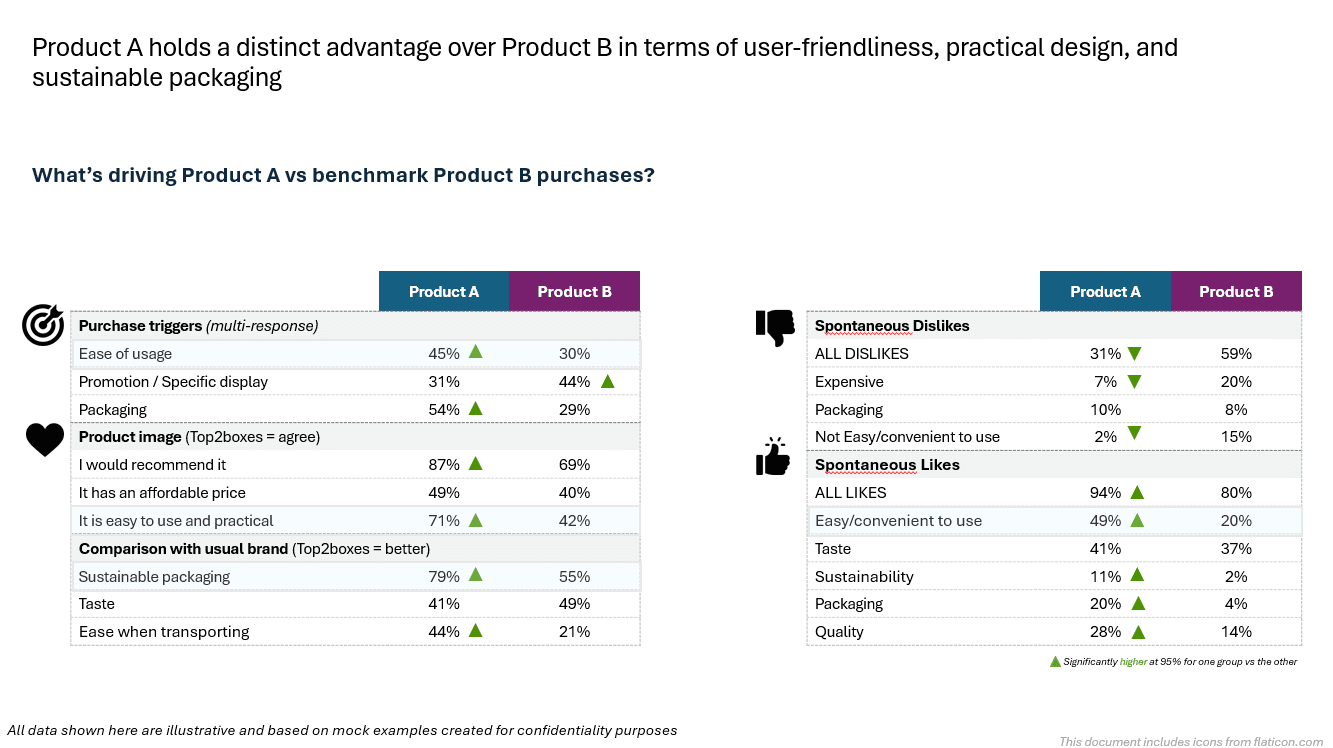

- Evaluation of key product dimensions: taste & texture (only food), packaging, innovation appeal, and value for money.

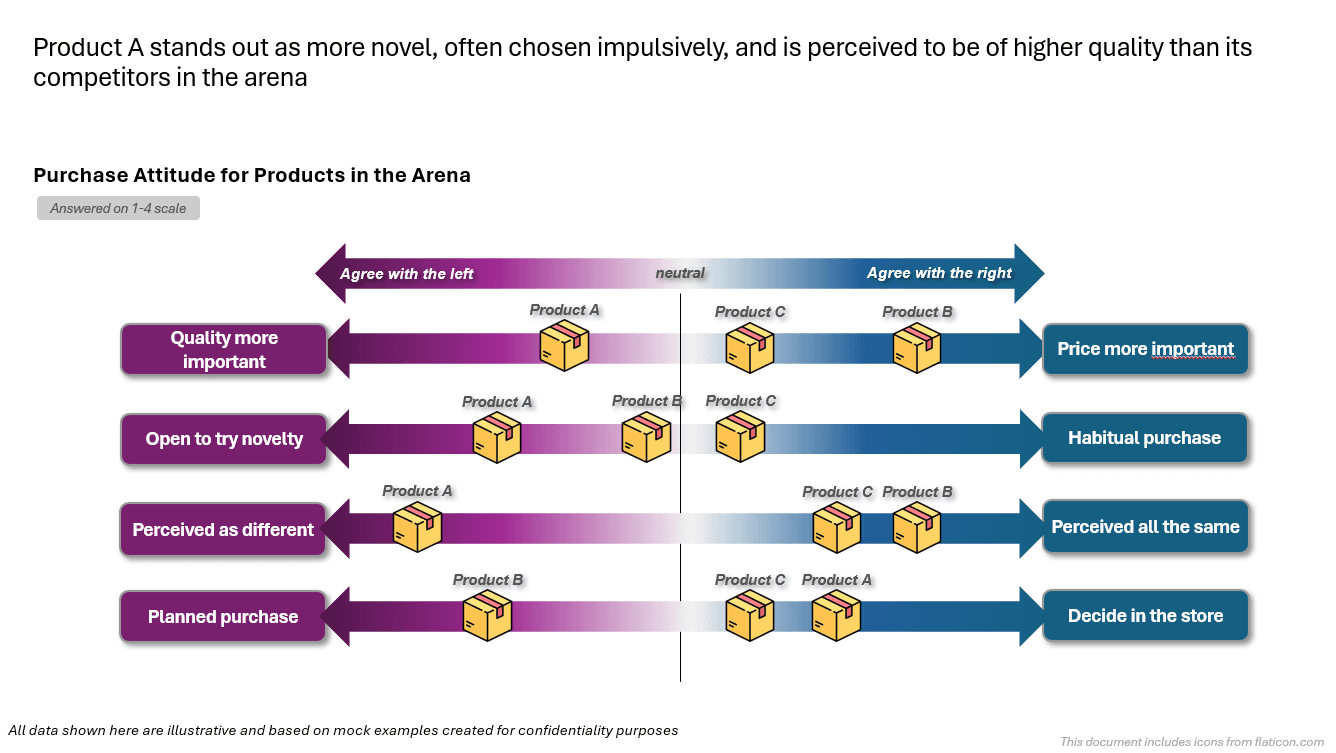

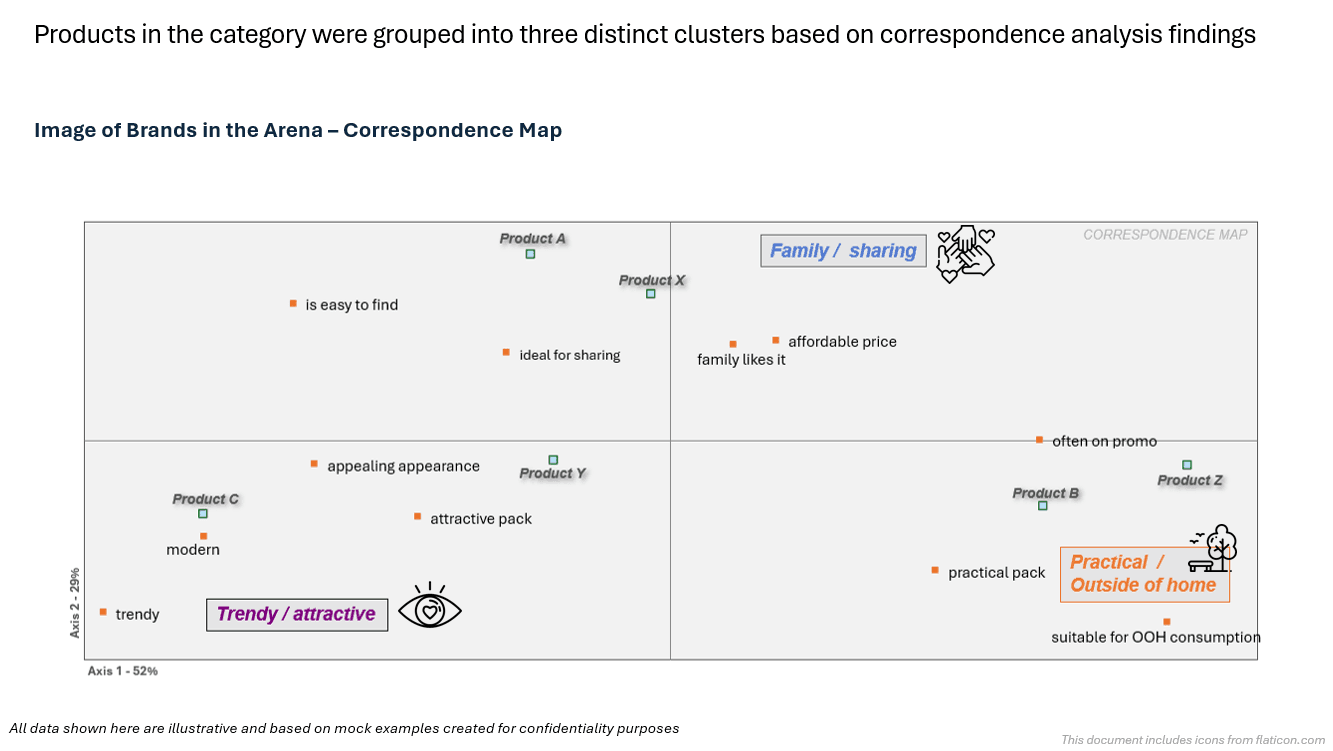

- Comparative analysis across competing products and benchmarks to identify differentiation opportunities.

- Integration of open-ended responses to capture consumer language, likes/dislikes, and suggestions for improvement.

Key Findings (anonymised & illustrative)

- Products perceived as innovative, convenient, and offering good value for money tend to achieve stronger repeat purchase intent.

- Packaging usability and portion size emerged as common pain points affecting satisfaction.

- Consumers valued authentic flavour and natural & healthy ingredients, particularly in premium segments.

- Clear communication of usage occasions (e.g., snack, meal companion, or indulgence moment) supported better product understanding.

Actionable Recommendations

- Optimise packaging format for ease of use and storage.

- Refine messaging to emphasize the product’s unique benefits and innovation story, as well as nutritional benefits.

- Leverage early buyer feedback to guide second-wave product improvements and future line extensions.

- Develop occasion-based positioning to expand consumption contexts and drive trial.

Role & Skills Demonstrated

Post-launch evaluation · Consumer feedback analysis · Product performance diagnostics · Competitive benchmarking · Insight synthesis for product innovation